Connection to DriversCloud Create a DriversCloud.com account Reset your DriversCloud.com password Account migration

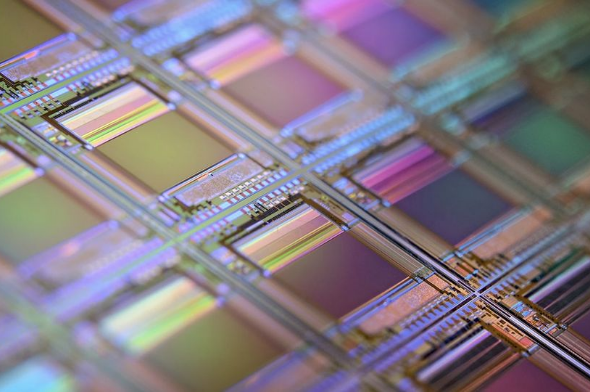

War in Ukraine: a new semiconductor crisis in sight?

The world's production of certain gases is highly dependent on the Ukrainian industry.

The war in Ukraine is a human tragedy, the likes of which Europe has not seen in over twenty years, and it is also causing trouble in the - inevitably somewhat selfish - semiconductor industry. The latter had been severely damaged by the Covid-19 pandemic and was just starting to get back on its feet. Major shortages in new sectors were caused by shifting demand and new logistical constraints. The graphics card market - but not only - had been particularly disrupted.

Now, Russia's invasion of Ukraine is highlighting other areas of fragility. Indeed, as Ars Technica explains, it turns out that to design semiconductors, it is necessary to use certain very specific gases. This is particularly the case in the lithography process or in the surface ionization process, where neon must be used. However, these gases cannot be used in any way, they must be of an almost perfect purity and few factories are capable of such production.

It just so happens that Ukraine has specialized in the production of these gases. Depending on the source, it is estimated that the world production of neon is 50% - 70% on Ukrainian companies alone. Obviously, if for the reasons we know today, they can not produce, it is the entire semiconductor industry that is concerned. Recall that the annexation of Crimea in 2014 had been followed by a rise in the price of neon by nearly 600%.

The problem is not limited to neon alone, as Ukraine is also a very large producer of krypton and xenon, also used by this industry. Moreover, while the major players in the semiconductor market are already looking to diversify their supply sources, several observers point out that the supply is simply not sufficient and even if investments are made to increase these alternative productions, it takes between 6 and 12 months for them to be certified. In fact, the eyes are partly turned towards China, another large producer, with a new dependency at stake.